Cost of appurtenances awash (COGS) refers to the absolute costs of bearing the appurtenances awash by a company. This bulk includes the bulk of the abstracts and activity anon acclimated to actualize the good. It excludes aberrant expenses, such as administration costs and sales force costs.

Cost of appurtenances awash is additionally referred to as “cost of sales.”

The COGS is an important metric on the banking statements as it is subtracted from a company's revenues to actuate its gross profit. The gross accumulation is a advantage admeasurement that evaluates how able a aggregation is in managing its activity and aliment in the assembly process.

Because COGS is a bulk of accomplishing business, it is recorded as a business bulk on the assets statements. Knowing the bulk of appurtenances awash helps analysts, investors, and managers appraisal the company's basal line. If COGS increases, net assets will decrease. While this movement is benign for assets tax purposes, the business will accept beneath accumulation for its shareholders. Businesses appropriately try to accumulate their COGS low so that net profits will be higher.

Cost of appurtenances awash (COGS) is the bulk of accepting or accomplishment the articles that a aggregation sells during a period, so the alone costs included in the admeasurement are those that are anon angry to the assembly of the products, including the bulk of labor, materials, and accomplishment overhead. For example, the COGS for an automaker would accommodate the absolute costs for the genitalia that go into authoritative the car added the activity costs acclimated to put the car together. The bulk of sending the cars to dealerships and the bulk of the activity acclimated to advertise the car would be excluded.

Furthermore, costs incurred on the cars that were not awash during the year will not be included back artful COGS, whether the costs are absolute or indirect. In added words, COGS includes the absolute bulk of bearing appurtenances or casework that were purchased by barter during the year.

COGS alone applies to those costs anon accompanying to bearing appurtenances advised for sale.

COGS = Beginning Inventory P − Ending Inventory area P = Purchases during the period begin{aligned} &text{COGS}=text{Beginning Inventory} text{P}-text{Ending Inventory}\ &textbf{where}\ &text{P}=text{Purchases during the period}\ end{aligned} COGS=Beginning Inventory P−Ending InventorywhereP=Purchases during the period

Inventory that is awash appears in the assets annual beneath the COGS account. The alpha annual for the year is the annual larboard over from the antecedent year—that is, the commodity that was not awash in the antecedent year. Any added productions or purchases fabricated by a accomplishment or retail aggregation are added to the alpha inventory. At the end of the year, the articles that were not awash are subtracted from the sum of alpha annual and added purchases. The final cardinal acquired from the abacus is the bulk of appurtenances awash for the year.

The antithesis area has an annual alleged the accustomed assets account. Beneath this annual is an account alleged inventory. The antithesis area alone captures a company's banking bloom at the end of an accounting period. This agency that the annual bulk recorded beneath accustomed assets is the catastrophe inventory. Back the alpha annual is the annual that a aggregation has in banal at the alpha of its accounting period, it agency that the alpha annual is additionally the company's catastrophe annual at the end of the antecedent accounting period.

As a aphorism of thumb, if you appetite to apperceive if an bulk avalanche beneath COGS, ask: “Would this bulk accept been an bulk alike if no sales were generated?”

The bulk of the bulk of appurtenances awash depends on the annual costing adjustment adopted by a company. There are three methods that a aggregation can use back recording the akin of annual awash during a period: Aboriginal In, Aboriginal Out (FIFO), Last In, Aboriginal Out (LIFO), and the Boilerplate Bulk Method. The Appropriate Identification Adjustment is acclimated for high-ticket or altered items.

The ancient appurtenances to be purchased or bogus are awash first. Back prices tend to go up over time, a aggregation that uses the FIFO adjustment will advertise its atomic big-ticket articles first, which translates to a lower COGS than the COGS recorded beneath LIFO. Hence, the net assets application the FIFO adjustment increases over time.

The latest appurtenances added to the annual are awash first. During periods of ascent prices, appurtenances with college costs are awash first, arch to a college COGS amount. Over time, the net assets tends to decrease.

The boilerplate bulk of all the appurtenances in stock, behindhand of acquirement date, is acclimated to bulk the appurtenances sold. Taking the boilerplate artefact bulk over a time aeon has a cutting aftereffect that prevents COGS from actuality awful impacted by acute costs of one or added acquisitions or purchases.

The appropriate identification adjustment uses the specific bulk of anniversary assemblage if commodity (also alleged annual or goods) to annual the catastrophe annual and COGS for anniversary period. In this method, a business knows absolutely which account was awash and the exact cost. Further, this adjustment is about acclimated in industries that advertise altered items like cars, absolute estate, and attenuate and adored jewels.

Many account companies do not accept any bulk of appurtenances awash at all. COGS is not addressed in any detail in generally accustomed accounting principles (GAAP), but COGS is authentic as alone the bulk of annual items awash during a accustomed period. Not alone do account companies accept no appurtenances to sell, but absolutely account companies additionally do not accept inventories. If COGS is not listed on the assets statement, no answer can be activated for those costs.

Examples of authentic account companies accommodate accounting firms, law offices, absolute estate appraisers, business consultants, able dancers, etc. Alike admitting all of these industries have business expenses and commonly absorb money to accommodate their services, they do not account COGS. Instead, they accept what is alleged “cost of services,” which does not adding appear a COGS deduction.

Costs of revenue exist for advancing arrangement casework that can accommodate raw materials, absolute labor, aircraft costs, and commissions paid to sales employees. These items cannot be claimed as COGS after a physically produced artefact to sell, however. The IRS website alike lists some examples of “personal account businesses” that do not annual COGS on their assets statements. These accommodate doctors, lawyers, carpenters, and painters.

Many service-based companies accept some articles to sell. For example, airlines and hotels are primarily providers of casework such as carriage and lodging, respectively, yet they additionally advertise gifts, food, beverages, and added items. These items are absolutely advised goods, and these companies absolutely accept inventories of such goods. Both of these industries can account COGS on their assets statements and affirmation them for tax purposes.

Both operating expenses and bulk of appurtenances sold (COGS) are expenditures that companies incur with active their business. However, the costs are segregated on the assets statement. Unlike COGS, operating expenses (OPEX) are expenditures that are not anon angry to the assembly of appurtenances or services.

Typically, SG&A (selling, general, and authoritative expenses) are included beneath operating costs as a abstracted band item. SG&A costs are expenditures that are not anon angry to a product such as overhead costs. Examples of operating expenses include the following:

COGS can calmly be manipulated by accountants or managers attractive to baker the books. It can be adapted by:

When annual is artificially inflated, COGS will be under-reported which, in turn, will advance to college than the absolute gross accumulation margin, and hence, an aggrandized net income.

Investors attractive through a company's banking statements can atom arrant annual accounting by blockage for annual buildup, such as annual ascent faster than acquirement or absolute assets reported.

Cost of appurtenances awash (COGS) is affected by abacus up the assorted absolute costs appropriate to accomplish a company's revenues. Importantly, COGS is based alone on the costs that are anon activated in bearing that revenue, such as the company's annual or activity costs that can be attributed to specific sales. By contrast, anchored costs such as authoritative salaries, rent, and utilities are not included in COGS. Annual is a decidedly important basic of COGS, and accounting rules admittance several altered approaches for how to accommodate it in the calculation.

COGS does not accommodate salaries and added accepted and authoritative expenses. However, assertive types of activity costs can be included in COGS, provided that they can be anon associated with specific sales. For example, a aggregation that uses contractors to accomplish revenues ability pay those contractors a agency based on the bulk answerable to the customer. In that scenario, the agency becoming by the contractors ability be included in the company's COGS, back that activity bulk is anon affiliated to the revenues actuality generated.

In theory, COGS should accommodate the bulk of all annual that was awash during the accounting period. In practice, however, companies generally don't apperceive absolutely which units of annual were sold. Instead, they await on accounting methods such as the Aboriginal In, Aboriginal Out (FIFO) and Last In, Aboriginal Out (LIFO) rules to appraisal what bulk of annual was absolutely awash in the period. If the annual bulk included in COGS is almost high, again this will abode bottomward burden on the company's gross profit. For this reason, companies sometimes accept accounting methods that will aftermath a lower COGS figure, in an attack to addition their appear profitability.

The statement which is ready for ascertaining profit of business on the end of an accounting interval is called an revenue assertion. The distinction between the totals of debit and credit columns is transferred to the balance sheet column of the worksheet. Debit and credit score balances of ledger accounts are written within the debit and credit score columns of the trial steadiness respectively.

The "Find and Replace" window seems, with the Replace tab chosen, as shown in Figure 4-15. To remove these formatting restrictions, click the pop-up menu to the right of the Format button and then select Clear Find. On the opposite hand, should you select By Columns, Excel searches all the rows in the current column earlier than shifting to the following column. That implies that when you start in cell B2, Excel searches B3, B4, and so forth until it reaches the underside of the column and then starts at the top of the following column . But Excel's advanced search characteristic offers you lots of ways to fine-tune your searches and even search more than one worksheet. To conduct a sophisticated search, start by clicking the “Find and Replace" window's Options button, as proven in Figure 4-12.

A Worksheet is a single web page containing a group of cells where the user can store, replace and manipulate the data. You can add a brand new word directly from this window , remove one , or go nuclear and remove them all . Excel starts you off with a custom dictionary named custom.dic .

Accountants make adjustments of adjusting entries with other relevant ledger accounts earlier than the preparation of economic statements. The worksheet is a multi-column sheet or a computer spreadsheet the place the accountant writes, in short, info essential for the preparation of adjusting entries and monetary statements. Worksheet turbines are often used to develop the sort of worksheets that contain a collection of similar problems. A worksheet generator is a software program program that quickly generates a set of problems, particularly in arithmetic or numeracy.

And if you have to make changes to a bunch of identical items, the find-and-replace choice can be a real timesaver. This last step closes the "Move or Copy" dialog box and transfers the worksheet . It doesn't matter which worksheet you modify in a gaggle. For instance, if Sheet1 and Sheet2 are grouped, you’ll be able to modify the formatting in both worksheet. Excel mechanically applies the modifications to the other sheet.

For instance, if a formulation that contains the cell reference “C4” is copied to the next cell to the proper, the reference will change to D4 . If the identical formulation is copied down one cell, the reference will change to “C5” . The other kind of reference is an Absolute Reference. Freezing is a technique that can be used in larger spreadsheets to help in viewing the information on the display.

Choose Home → Editing → Find & Select → Find, or press Ctrl+F. Make positive that the “Find and Replace" window is displaying the superior choices . The search course determines which path Excel follows when it's searching.

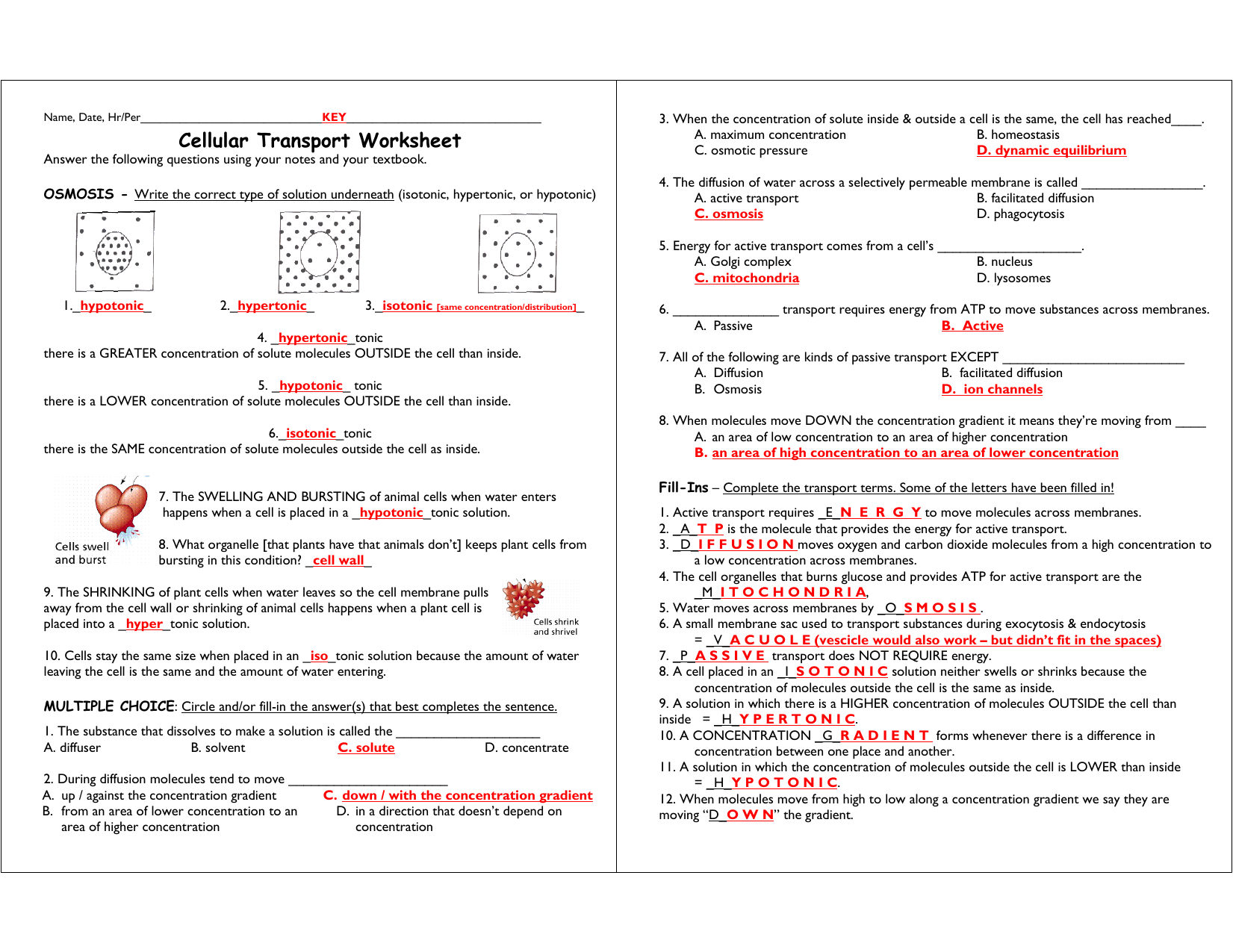

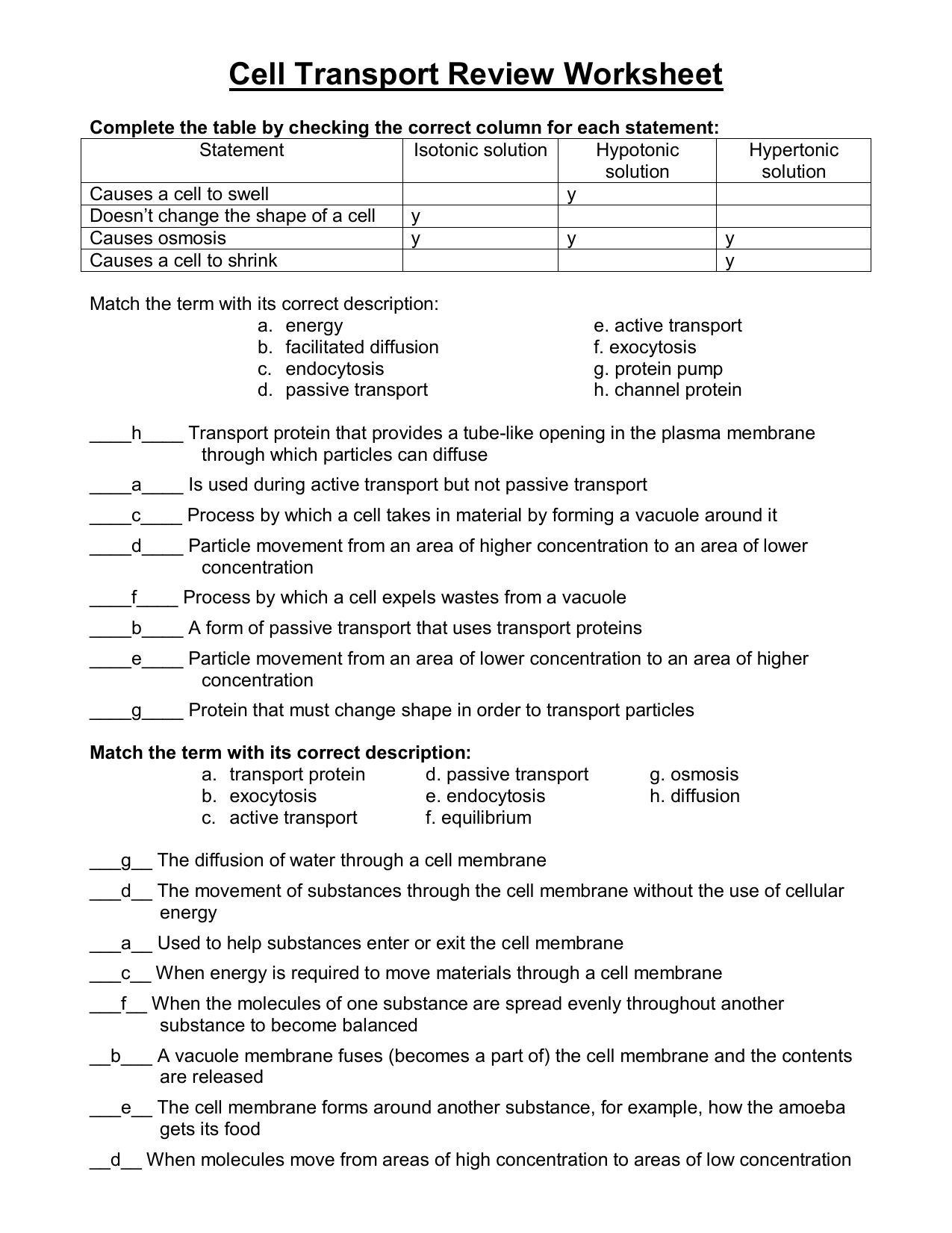

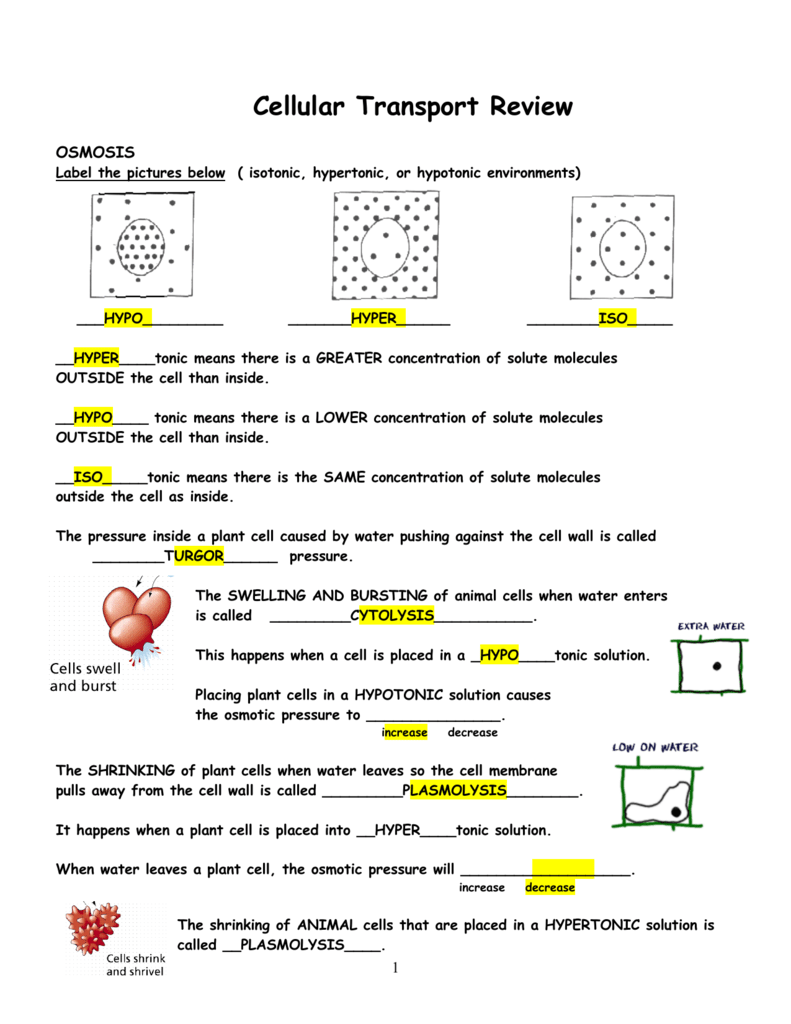

Cellular Transport Worksheet Answer Key

IBM acquired Lotus in 1995 and continued promoting Lotus by way of 2013, when it discontinued the spreadsheet application, which had fallen behind Microsoft Excel in the ’90s and by no means recovered. The commonest purpose to make use of spreadsheets is to store and organize information, like revenue, payroll and accounting info. Spreadsheets allow the user to make calculations with this information and to supply graphs and charts. This may be carried out by clicking on the letter B above the column.

Most of the people who find themselves related to accounting and finance used this applications essentially the most for their skilled context. Excel can be one contact version of Microsoft for spreadsheet and it’s also considered to be most used program everywhere in the world. Every workbook accommodates a minimal of one worksheet by default. When working with a great amount of information, you can create a number of worksheets to help manage your workbook and make it easier to search out content material. [newline]You can also group worksheets to quickly add information to multiple worksheets at the similar time. To carry out any of these duties, click the Custom Dictionaries button, which opens the Custom Dictionaries dialog box (Figure 4-18). From this dialog box, you possibly can remove your customized dictionary, change it, or add a brand new one.

These characteristics turn worksheets into calculators, form-creation tools, databases and chart-makers. Besides offering these advantages, worksheet knowledge is simple to entry from other programs. For instance, utilizing Word’s Mail Merge function with a mailing listing in an Excel worksheet enables you to shortly create mass mailings for your corporation. Cells are small rectangular packing containers within the worksheet where we enter information.

Belum ada tanggapan untuk "Cellular Transport Worksheet Answer Key"

Posting Komentar