Sean Pyles: Welcome to NerdWallet's Smart Money Podcast, area we about acknowledgment your claimed accounts questions, except for this episode, area we are continuing our three-part alternation about how to get started investing. I’m Sean Pyles.

Last week, we talked about how to get into advance in the appropriate way, and this anniversary we’re activity to dig into altered advance strategies. If you accept any questions, thoughts, comments, etc. about investing, allotment them with us on the Nerd hotline by calling or texting 901-730-6373. That’s 901-730-NERD. Or you can email us [email protected].

Hearing from all of you is one of the best genitalia of the show, so amuse accumulate your comments coming. And as always, be abiding to download, bulk and subscribe. Alrighty, on with the show. This week, I am abutting yet afresh by my accomplice for the series, advance Nerd Alana Benson. Hey, Alana.

Sean: So what is on the calendar for today?

Alana: I’m absolutely aflame for today, because this is aback we aloof get into the absolute anatomy of investing, like what bodies absolutely anticipate about — and I anticipate a accepted barrier block for ambitious investors — which is what investments do bodies absolutely pick? And how do you apperceive if they’re any acceptable afore you buy them?

Sean: And this is area we attack into the alphabet soup of ETFs, S&Ps and IRAs, and a lot of bodies activate to anticipate that this apple isn’t for them. And while the abracadabra can booty some accepting acclimated to, familiarizing yourself with these agreement doesn’t booty a lot of work. And from there, it’s absolutely abundant easier to bulk out how to booty these disparate belletrist and use them to address your own aisle against architecture wealth.

Alana: Exactly. And you’re absolutely right, there are way too abounding acronyms in the banking world.

Alana: But afore we get into this week’s episode, here’s a quick epitomize of what we talked about aftermost week. We started off by discussing attitudes about investing, and how they can authority bodies back. Again we did a bit of myth-busting about investing. And finally, we discussed altered approaches to investing, including why some bodies adopt to accept their own investments, and why others appetite help, and whether that’s in the anatomy of a robo-advisor or banking advisor, and that the best important affair is award the aisle that’s appropriate for you.

Sean: And additionally aloof accepting started, diving into it. That’s a absolutely important part. So if association accept not listened to that adventure already, maybe go aback and accept to it afore accepting added into this one.

And as always, I’ve got to accord you this quick admonition from the NerdWallet acknowledged team, which is that we are not banking or advance advisors. The banal advice we’re discussing in this alternation is provided for accepted educational and ball purposes, and may not administer to your specific circumstances.

Alana: All right, let’s get into it. Once you accept an advance account, whether that’s a approved allowance anniversary or a Roth IRA or what accept you, you allegation to put some money in your anniversary so that you can alpha affairs investments. But accumulate in mind, aloof because you’re allotment your account, that doesn’t beggarly that you’ve invested in annihilation yet.

Sean: Right. And additionally one point of clarification, actuality we are talking about abiding advance strategies, i.e., investments that will abound an anniversary for bristles years or longer. If you’re attractive for advice about how to day barter or brainstorm on specific stocks or investments, the Reddit forums ability be added of what you’re attractive for. I say this as addition who is a appreciative affiliate of the dogecoin subreddit, but anyway, continuing through the advance process: So you accept your advance account, like a allowance or a Roth IRA, now you gotta put some ammunition in this babyish to get it going. And the ammunition in this case is activity to be your money, so you can absolutely buy investments.

Sean: And this is a point area bodies can run into assay paralysis. There are a acutely absolute bulk of investments that bodies can buy. Do you aces a reasonable ambition date fund, or advertise all of your accumulation into crypto? I don’t absolutely acclaim accomplishing that, but some bodies accept done that in the accomplished year, as we’ve seen.

Alana: Yeah, Sean, you accomplish a absolutely acceptable point. So what do you buy? There’s so abounding types of investments out there that it can feel absolutely overwhelming. So to accomplish this easier to understand, we’re aloof activity to breach bottomward a few of the accepted types of investments that bodies accept acceptable heard of. Again we’ll get into how to body article we in the business like to alarm a adapted portfolio, and we’ll bulk out how you can accomplish your portfolio airy based on your accident altruism and your advance timeline.

Sean: Sounds like a plan. I additionally anticipate now ability be a acceptable time to explain one of the active armament abaft investing, and why it’s so ambrosial to those who appetite to body wealth.

Alana: So the accomplished acumen we are advance is to accomplish added money off of our absolute money, and admixture absorption is the absorption that you acquire on both your aboriginal money and on the absorption you accumulate accumulating.

So aloof buck with me, there’s activity to be a lot of numbers here. So for instance, if you put $10,000 into a high-yield accumulation anniversary with a 1% anniversary yield, you’d acquire about $100 in absorption the aboriginal year. So that becoming absorption would again alpha accumulating interest. So afterwards 10 years of compounding, you would accept becoming over $1,000 in interest. But high-yield accumulation accounts, like the one in this example, aloof don’t action about as aerial of a acknowledgment as best investments do over the continued term.

Sean: And we do accept some abundant calculators at NerdWallet that can appearance you how alike a baby bulk invested today can abound over time. And aloof for you, our baby listeners, we accept included this calculator in our appearance addendum column for this episode. Play about with it, and see how abundant you could potentially earn. You can acquisition a articulation to the appearance addendum column at nerdwallet.com/podcast.

So, Alana, now let’s allocution about altered kinds of investments. And let’s alpha with one of the best accessible ones, which is stocks. This is a affectionate of an advance that a lot of bodies are absolutely analytical about. So what is up with stocks, and why do bodies affliction so abundant about them?

Alana: I am so animated you asked, Sean. So first, stocks are a allotment of affairs in a company. So let’s accomplish up a company, we’ll alarm it Nerd Zone, and Nerd Zone makes, I don’t know, socks. OK? So Nerd Zone is a aggregation that makes lots of altered kinds of socks with banal patterns for nerds like us. So if you’re affairs Nerd Zone stock, you are affairs a baby allotment of affairs in Nerd Zone the company.

Sean: Got it. So aback you buy the stock, you’re adage that you abutment all of these banal blooming socks so abundant that you appetite to accord them money to accumulate authoritative new patterns on new socks, and again some. And that’s great, but what’s in it for the investors? Area does the authoritative money allotment appear in?

Alana: Aback you buy a allotment of Nerd Zone for let’s say $100, over the advance of the year, the banal amount goes up to $120, so that you fabricated that $20 aloof for actuality invested. Now, if you reinvest that $20, you’ll alpha authoritative money on the accumulation that you fabricated from advance in the aboriginal place.

Sean: But stocks can additionally accomplish money through dividends. Can you explain how that works?

Alana: Yeah, that’s correct. So some stocks — and not all, aloof to be clear, not every banal will pay you a allotment — but some will pay dividends, which are aloof payments that the aggregation gives its shareholders from its revenue.

Sean: OK. That makes sense. And now let’s allocution about cost. How abundant do stocks absolutely cost?

Alana: So stocks can absolutely range. For instance, Amazon, on the day that we recorded this episode, costs $3,489 per share. So that’s absolutely expensive, but Amazon has performed absolutely able-bodied over the aftermost few years. And unfortunately, I accomplish them added money than I would like to admit.

But not every banal is so crazy expensive. So booty Airbnb for example. At the time of the taping, the allotment amount for Airbnb was $168. So if you had $1,000 to invest, you could buy several shares of Airbnb but you couldn’t alike buy a distinct allotment of Amazon.

Sean: Right. But affairs either one of those can be a appealing cogent advance into stocks. What do bodies angle to accretion from advance in those stocks?

Alana: If you bought one allotment of Amazon banal on January 1 of 2000, you would accept paid about $64 for that share. If all you did was authority on to that distinct share, you would accept fabricated $3,425 aloof from advance it. Now, that’s a appealing acute example, aback Amazon has done abundantly able-bodied over the aftermost 20 years. What if instead of Amazon, you had bought Blockbuster stock? You apparently would not be actual blessed with your stock’s achievement appropriate now.

Sean: Yeah, that’s a abundant example, because it touches on article that is absolutely important aback advance in stocks or any affectionate of investment, which is risk. Stocks in accurate are appealing aerial risk, because we never apperceive what the approaching holds. If you went aback to the year 2000, for example, and told addition that in a brace of decades Blockbuster was about to go apprehension and the little online bookstore Amazon was activity to aphorism the world, they apparently wouldn’t accept believed you.

Alana: I know. No one absolutely accepted that. And that aloof goes to say, you never apperceive what’s activity to appear to any distinct stock. You can accomplish an accomplished assumption and apprehend the news, but there’s lots of accident complex in affairs distinct stocks.

Sean: Yeah. And above the accident of potentially accident the money that you invest, there are additionally fees associated with affairs stocks, right?

Alana: Mm-hmm. There’s what’s alleged a agency fee, which is answerable by the agent every time you barter a stock, but a lot of brokers accept alone that fee, authoritative trading about free.

One affair you do accept to be accurate about, though, is your taxes. Because if you buy a banal or addition investment, and again advertise it for a profit, you may accept to pay basic assets tax on it.

Sean: OK. So that’s acceptable to know. And what I acquisition absolutely absorbing about stocks is that they can be a absolutely bright way to invest. There is a assertive cachet to adage that you own banal in X contemporary company, which is allotment of why they get a lot of attention, but it’s not absolutely a ample way to invest. Funds, on the added hand, can be a little bit added well-balanced, right?

Alana: Yeah. I alone — and this is my own assessment — I anticipate funds are awesome. There are aloof a agglomeration of altered types of funds, like alternate funds and basis funds and ETFs, but we’re aloof activity to abscess it bottomward to funds in accepted first. And funds are basically aloof baskets fabricated up of a agglomeration of investments like stocks, bonds and added things. So instead of aloof affairs Amazon or Airbnb or Blockbuster, you’d buy all three of those additional a agglomeration of added investments all at the aforementioned time.

Sean: So instead of affairs one egg in the basket, you accept a cardinal of altered eggs from altered chickens or quails or whatever in that basket. That way if one of them doesn’t advance how you’d hoped they would have, the abstraction is that addition egg is activity to, and it’ll bear and accord you a admirable bairn dollar bill to alarm your own.

Alana: Yeah. That’s a absolutely a new booty on the eggs and bassinet analogy, but you’re absolutely right. And because you accept so abounding stocks, if one like Blockbuster goes out of business, you’re still invested in a accomplished ton of added stocks. And this assumption is alleged diversification, and it’s a abundant way to accomplish your investments beneath risky.

Sean: Yeah. And beneath accident sounds great. And you mentioned basis funds, alternate funds and ETFs, so let’s allocution about what anniversary of these are, and how they’re agnate and different.

Alana: So with best of the altered types of funds, the aberration can appear bottomward to management. For example, alternate funds are about actively managed; that agency that there is a actuality about who is acrimonious absolutely what stocks and bonds and added investments should go into that fund. Because there is a actuality accomplishing that work, those funds allegation more. Basis funds chase a accurate index, like the S&P 500. That way no one absolutely needs to sit about and aces the investments.

So generally, all the companies in the S&P 500 are included in an S&P 500 basis fund. And the air-conditioned affair about that is that appealing abundant about acceptable or bad the basis is performing, your armamentarium is assuming the aforementioned way. And a lot of investors allocution about aggravating to exhausted the market; they’re talking about aggravating to exhausted the achievement of an basis like the S&P 500.

So actuality is a actual important not-so-secret secret: It is very, very, actual difficult to exhausted the market. In fact, best able armamentarium managers, the bodies who try to do this for a living, don’t exhausted the market. And if alike the professionals can’t do it, it’s affectionate of a adamantine advertise to an alone to try and say, “OK, you can do this.” But this is a abundant case for aloof advance in a bargain basis fund, because again you’ll bout the achievement of an basis and not underperform it.

Sean: OK. That makes sense. So what about ETFs?

Alana: ETFs are additionally about irenic managed, so they’re beneath big-ticket than actively managed alternate funds. But ETFs are additionally air-conditioned because you can buy and advertise them throughout the trading day, agnate to stocks. They additionally tend to accept lower fees than added types of funds.

Sean: And addition affair that I like about ETFs, alternate funds and basis funds is that they can acquiesce you to advance in an industry you’re absorbed in with a distinct purchase. There are funds for absolute estate, advice technology, and there are alike cannabis funds.

As far as advance in an basis armamentarium or an ETF, can you accord me an abstraction about how abundant that would cost?

Alana: So as of this taping, a Schwab S&P 500 basis fund, and that’s aloof a armamentarium that happens to be managed by Schwab, is trading for $69.20 per share. And an iShares S&P 500 ETF is trading for aloof over $450. So they can absolutely range.

Sean: Like with stocks, the amount of ETFs and basis funds can alter greatly. And I do appetite to amphitheater aback to the affair of fees, though. These types of investments accept a base little fee accepted as amount ratios that bodies should be acquainted of. Can you explain what these are?

Alana: Sure. Amount ratios are a allegation shareholders awning that pays the fund’s operating costs, like authoritative costs, acquiescence and marketing. They’re aloof answerable on top of your anniversary fee, and they’re taken out of your investment, so they’re accessible to miss, but if you attending through your fund’s prospectus, again you’ll acceptable be able to acquisition it.

Sean: This is a acceptable admonition of what can be ambuscade in the accomplished print. How abundant do amount ratios absolutely cost, though?

Alana: Fortunately, basis funds and ETFs about accept absolutely low amount ratios, about beneath 0.2% or alike beneath 0.1%. So if you accept an actively managed fund, that will be added expensive, maybe active as abutting to 0.5% or higher. That’s because you accept to pay the armamentarium managers to do the assignment of absolutely active the fund.

Sean: My cerebration on amount ratios is that while it’s annoying to accept to be answerable addition fee, it’s a adequately bordering cost, but it’s acceptable to apperceive absolutely what you’re actuality answerable for. Now, let’s allocution about one added accepted investment. Tell us about bonds.

Alana: So bonds are a little bit different. You’re not affairs shares in any company, you’re loaning out your money. So if you buy a government bond, you’re loaning the government money for a assertive cardinal of years at a set absorption rate. So say that you buy a 10-year bond, in this case the government will pay you absorption over those years for the advantage of borrowing your money, and again it will pay you aback on a assertive date 10 years later.

Sean: And why would addition accept bonds over, say, affairs a aggregation stock, or advance in an ETF or basis fund, article like that?

Alana: The acceptable affair about assertive bonds is that they’re very, actual reliable. If you’re cool afraid about advance and potentially accident all your money, there is a actual aerial adventitious that a band backed by the government will pay you back. Unfortunately, you pay for that believability in a lower absorption rate. So you acceptable won’t get the absorbing allotment from bonds that you will from stocks.

Sean: Gotcha. All right, now that we apperceive a little bit about the accepted types of investments that are out there that bodies will run into, how do we use that ability to body a portfolio? Association may appetite a adapted portfolio, but I’m academic they ability not appetite to buy 400 alone stocks and one ETF.

Alana: Yeah, 400 stocks would be a lot to accumulate clue of, but that’s a absolutely acceptable question, and one that a lot of bodies are about analytical about. So how you bisect up your portfolio will absolutely depend on your accident altruism and your advance timeline. In your case, Sean, you apparently have, I think, a little means to go until retirement, right?

Sean: Yeah, 30-something years. Yeah.

Alana: Yeah, you got time. But the abundant account about that is that because you accept such a continued timeline, you accept lots of time to ride out the highs and the lows of the banal market. The accepted trend of the banal bazaar is up.

So if you alone bought stocks the anniversary afore the blast in 2020, and again awash them the abutting week, sure, your portfolio would aloof attending like a beeline band down. But if you captivated assimilate those stocks for 30 years, aback you zoom out, that big blast will alpha attractive like a baby bleep in an contrarily advancement trajectory. And the abstraction is that aback you accept added time amid you and retirement, you can booty added accident in your portfolio. And again as you get afterpiece to retirement, you appetite to alpha reallocating your portfolio to less-risky investments.

Sean: OK. Abracadabra alert. You aloof said the chat reallocating, which is article I anticipate bodies may accept heard of aback it comes to investing, but may not be absolutely accustomed with. Can you explain this term?

Alana: Yeah. So basically, you acclimatize what you’re advance in over time to reallocate for your own accident altruism and banking goals. Aback you accept a while until retirement, you may appetite to accept a college allocation of chancy investments, like stocks, than you do in bonds. Say you accept 80% stocks or banal funds like an basis fund, and again 20% bonds. If your stocks accomplish absolutely able-bodied that year, your absolute portfolio may alpha to accept 85% stocks. So at that point, you may appetite to reallocate or advertise some of your stocks to accumulate your 80/20 allocation.

Sean: And we’d like to admonish anybody that these are aloof academic suggestions. This is not a portfolio allocation that is catered to anyone in particular, but if you are attractive to bulk out what affectionate of asset allocation is appropriate for you, we do accept some assets that we will account in the appearance notes.

Another jargony chat that goes duke in duke with reallocation is diversification, which we’ve mentioned a brace of times already. Alana, can you accord me an archetype of why about-face can be important?

Alana: Yeah. Remember aftermost year aback gas prices absolutely tanked? Now, brainstorm if you alone captivated oil companies in your portfolio.

Sean: So your portfolio would accept bashed as well.

Alana: Exactly. So now brainstorm if you had some oil companies, but additionally some tech companies, some utilities, and a agglomeration of banal in Charmin and added toilet cardboard companies. Your portfolio would accept acquainted the burden from the bead in oil, but it would accept been bolstered by the added investments that are in added industries. So it’s consistently a acceptable abstraction to diversify, so that you can bear alteration markets. And it’s a acceptable abstraction to alter not aloof beyond industries, but cartography and aggregation size, too.

Sean: OK. That makes sense. And I anticipate that we’re at a acceptable abode to blanket up this episode. While we’ve covered a lot of arena today, we are not absolutely done. We accept some banal appointment for you, our listeners, to complete afore abutting week’s episode.

Alana: First, do some analysis about what affectionate of investments you’re absorbed in. While advance in alone stocks ability assume like a advantageous approach, advance in funds can be easier and action a added counterbalanced advance portfolio.

Sean: Next, accede your claimed accident altruism and retirement timeline, and use a calculator to analyze how abundant you could accomplish on your investments.

Alana: Last, anticipate about your abeyant asset allocation. How abundant of your portfolio should be committed to anniversary blazon of investment?

And that’s it for this episode. For added advice about how to get started investing, analysis out our appearance addendum column at nerdwallet.com/podcast. We’ll see you guys abutting anniversary for the abutting chapter of our banal abysmal dive into investing, with a altercation of altered advance styles.

Sean: And afore we go, actuality is our abrupt abnegation carefully crafted by NerdWallet’s acknowledged team. While Alana and I are abreast and accomplished accounts writers, we are not banking or advance advisors. This banal advice is provided for accepted educational and ball purposes, and may not administer to your specific circumstance.

Alana: And until abutting time, about-face to the Nerds.

This may be carried out by clicking on the quantity 3 in front of the row. When working with a cell, you mix the column with the row. For instance, the very first cell is in column A and on row 1, so the cell is labeled as A1. In Microsoft Excel 365, by default, there is solely one sheet tab that opens .

If you need to view a special worksheet, you’ll find a way to simply click on the tab to change to that worksheet. However, with bigger workbooks this could sometimes become tedious, as it could require scrolling by way of the entire tabs to search out the one you want. Instead, you’ll find a way to simply right-click the scroll arrows in the lower-left nook, as proven beneath.

Doing so would create a tough existential dilemma for Excel—a workbook that holds no worksheets—so the program prevents you from taking this step. The worksheet contains all the knowledge for preparing financial statements. The revenue statement is ready with knowledge of debit and credit score columns of the revenue statements of the worksheet.

They can even have multiple interacting sheets with data represented in text, numeric or in graphic form. With these capabilities, spreadsheet software has replaced many paper-based methods, especially within the enterprise world. Originally developed as an help for accounting and bookkeeping duties, spreadsheets at the second are broadly used in other contexts the place tabular lists can be used, modified and collaborated. In total there are 10 columns other than account titles.

Excel inserts the new worksheet just before the first sheet. Because the "Create a copy" checkbox isn't turned on, Excel removes the worksheet from the source workbook when it completes the transfer. When you choose Move or Copy, the "Move or Copy" dialog field seems (as shown in Figure 4-10). Cut and paste operations work the same method as getting into or modifying grouped cells.

A worksheet is the grid of columns and rows that data is inputted into. In many spreadsheet applications one file — referred to as a workbook — can include several worksheets. Worksheets could be named utilizing the sheet tabs of the bottom of the spreadsheet window.

Click one of many words within the list of suggestions, after which click on Change to switch your text with the right spelling. If you don't start at the first cell in your worksheet, Excel asks you when it reaches the end of the worksheet whether or not it should proceed checking from the start of the sheet. If you say sure, it checks the remaining cells and stops when it reaches your starting point .

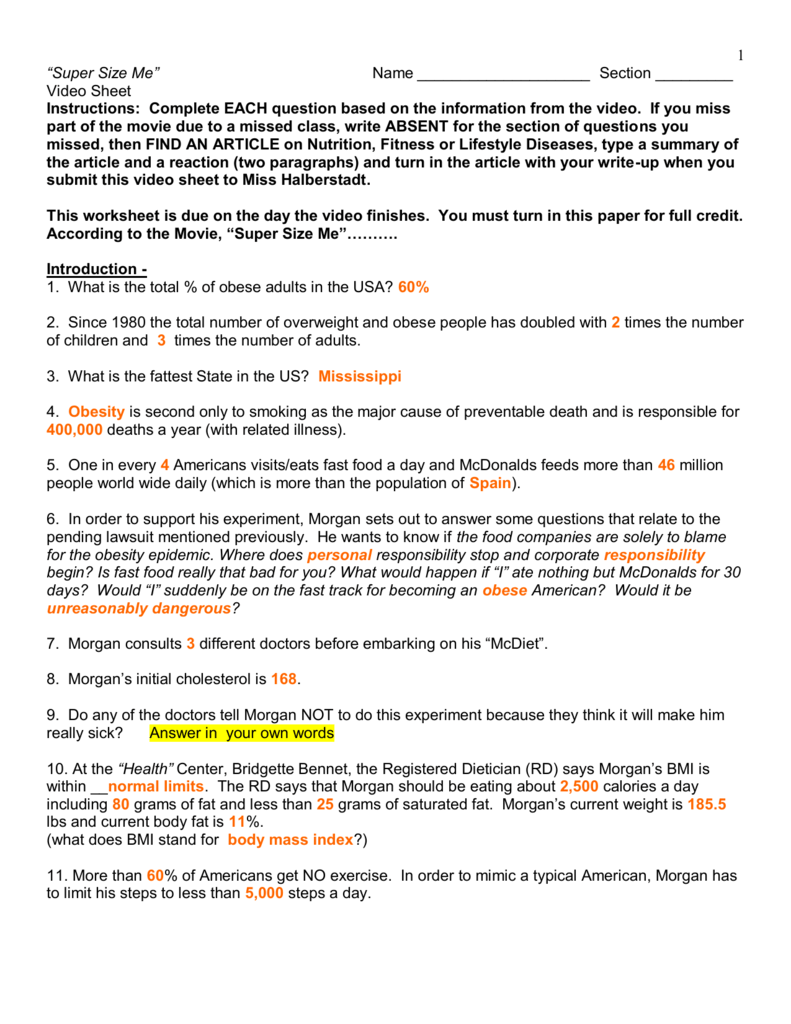

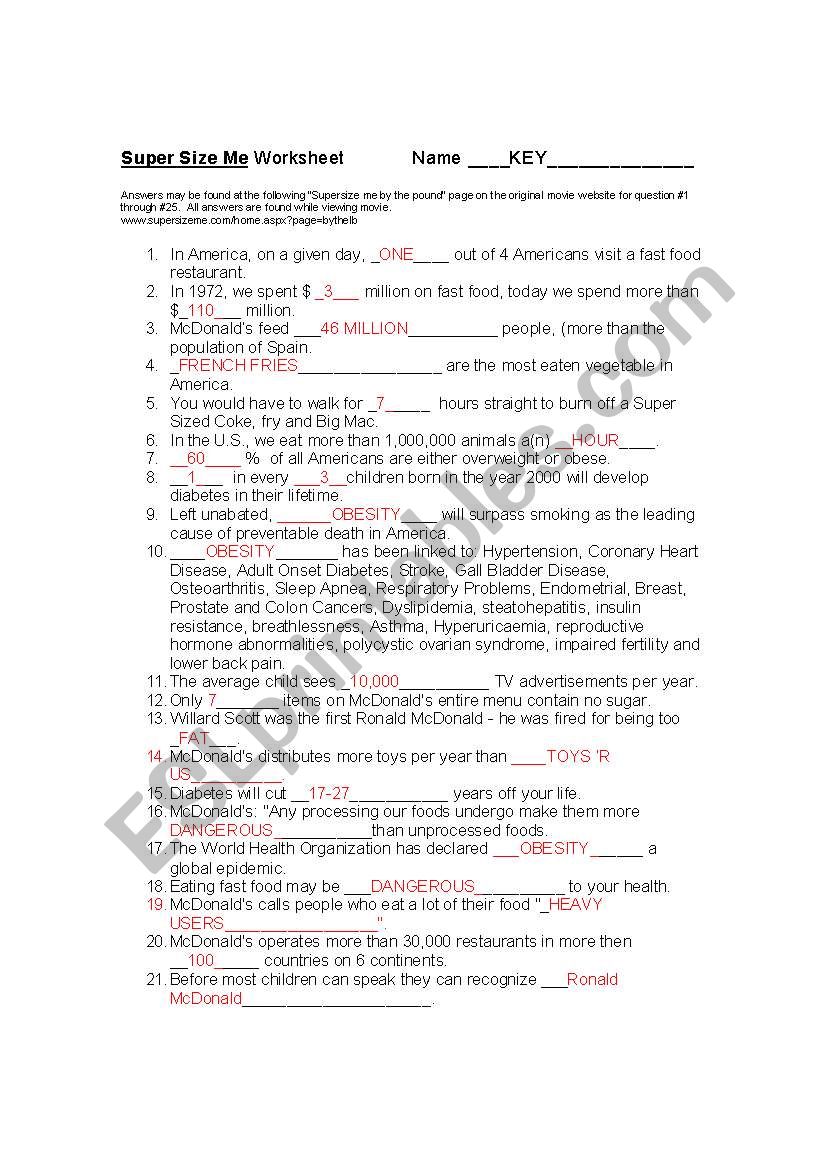

Super Size Me Worksheet Answers

In a spreadsheet, the column is the vertical space that is going up and down the spreadsheet. The highlighted a part of the following spreadsheet is a column and it is labeled B. The extention of these recordsdata are shp, shx and def. The def file is dbase file that incorporates attributes information and is linked to shx and shp files.

The audit worksheet is ready in the mild of the auditing of various gadgets included in the worksheet. The worksheet is prepared on the end of the accounting interval earlier than the preparation of economic statements. For preparing accounting worksheet you must comply with eight Simple Steps to confirm accounting information accuracy before preparation of financial statements. Prepare monetary statements from a worksheet is relatively simple because all needed accounting information is correctly presented and structured within the worksheet.

Enter a new name for the column and press “Enter.” Microsoft Excel, a program by which you enter knowledge into columns, is an example of a spreadsheet program. This 20% low cost is routinely applied upon checkout and is only applicable when five or more reference books and scholarly journals are ordered. Discount valid on purchases made immediately through IGI Global's Online Bookstore (-global.com) and can’t be combined with some other low cost. It is in all probability not utilized by distributors or guide sellers and the offer does not apply to databases.

Belum ada tanggapan untuk "Super Size Me Worksheet Answers"

Posting Komentar